WHO IS F.I.G.

Financial Infusion Group, LLC (F.I.G.) is a privately owned cooperative of strong local investors and financial and real estate professionals providing customized sub-50k short-term funding packages to small businesses, real estate investors, and, on a case-by-case basis, individuals.

Through a combination of traditional and alternative loan evaluation methods, we provide REAL ACCESS to capital, for the traditionally under-served: small business, and especially minority-owned and women-owned businesses.

Our collective experience keeps us driven towards the same mission: to level the economic playing field by closing the equity gap caused by traditional lending and investment bias.

Founder, Adrian N. Jones

Adrian is the Founder and Managing Director of Financial Infusion Group, LLC. After 22 years in the Information Technology field, Adrian realized he would obtain a deeper sense of purpose and fulfillment helping others achieve their dreams. With that goal in mind, he used his own personal finances to begin building a company that has served as a stepping-stone to financial empowerment and success for many small businesses and individuals in, and around, his community. And as his clients will attest, he strives to put the personal touch back into finance.

He believes hard-working people, regardless of socioeconomic status, deserve the opportunity to improve their financial status and provide legacies, as he hopes to do for his own family, and especially his son, Bryce.

SERVICES

F.I.G. understands the synergistic relationship between thriving small businesses and financially prosperous households. One does not excel without the support of the other. For this reason, we provide short-term funding in support of the following small business and individual purposes:

BOARD OF ADVISORS

CLIENT ENDORSEMENTS

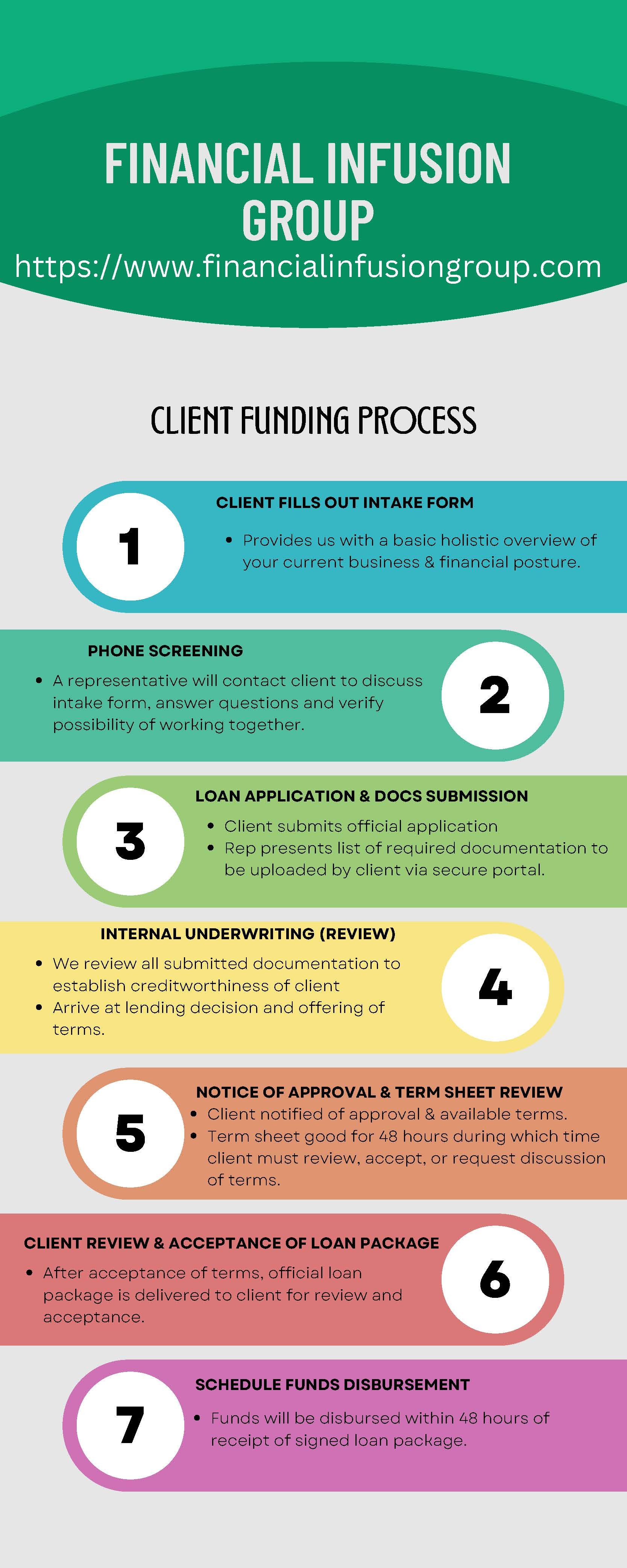

THE FUNDING PROCESS

We Hope This Helps!

We understand the lending process can be stressful, and frustrating especially when you have no way of knowing where you are in the process. So, before you begin, please take a look at the 7 high-level phases of our underwriting process.

Let us know a little bit about you, how you run your business, and your current financial needs by clicking on, and filling out the Client Intake Form. We look forward to meeting you!

Once we mutually establish the potential to work together, it’s time to fill out the Loan Application.

Trust but verify! We believe you, but we need you to support your story with documentation. Please upload all requested documentation to us for review. For the protection of your Personally Identifiable Information, we ask that you ONLY send us your documents via our Secure Document Portal.